What do I have to pay when I make someone redundant?

This article provides guidance on the minimum legal payment requirements when making an individual (or group) redundant.

There are three major areas of risk for businesses when implementing redundancies:

1. Making sure the reasons are lawful;

2. Complying with the required process; and

3. Paying all the right entitlements and, on time!

Failing to meet the legal requirements involved in the above items can expose you and your company to potential compensation orders and substantial fines as well.

This article is designed to help guide you as to the right entitlements and timing when you have to dismiss an employee(s) due to a genuine redundancy(ies).

The Basics

The short version is that you will need to provide the following entitlements:

Notice of termination (or payment in lieu)

Redundancy pay (aka severance)

Annual leave (where it has been accrued but not taken)

Long service leave (where it has accrued due to service and not been taken)

Accrued but untaken paid personal/carer’s leave (if the enterprise agreement provides for this to occur)

We provide a more detailed explanation and analysis below!

Notice

All employees are entitled to be given notice of the termination of their employment.

In some circumstances, it may be appropriate to have the employee work out the notice period. However, in the vast majority of circumstances, an employer will be required to pay out the notice period (known as ‘paid in lieu’).

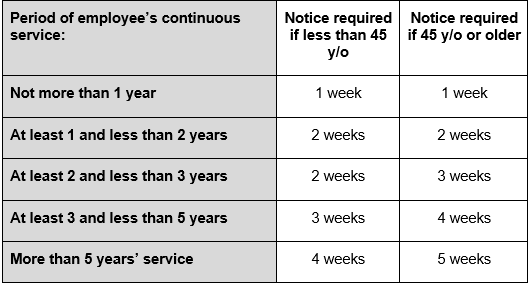

What amount of notice must be given?

The amount of notice required to be given on termination due to redundancy, should really be prescribed by the employment contract.

An employer must not terminate an employee unless they have either:

given the minimum period of notice; or

paid the employee instead of giving notice.

The minimum required by law is according to the following scale:

Uncertain? Don't worry, we've got your back! Reach out to our Advice Line for expert guidance. Not on board yet? Explore more to see what we offer.

Already part of the family? Log in now for tailored support and solutions.

Other Sources

If an enterprise agreement or contract of employment provides for a longer period of notice, then you will need to comply with the longer period of notice in the enterprise agreement or contract of employment.

Calculating a ‘Week’

Notice is to be paid at the rate the employee would have received had they worked during the period (referred to as the ‘full rate of pay’).

However, this will not include non-guaranteed incentive-based payments/bonuses, penalty loadings not ordinarily paid, allowances or other separately identifiable unless they would have been payable for working the hours to the end of the notice period.

Redundancy Pay (Severance)

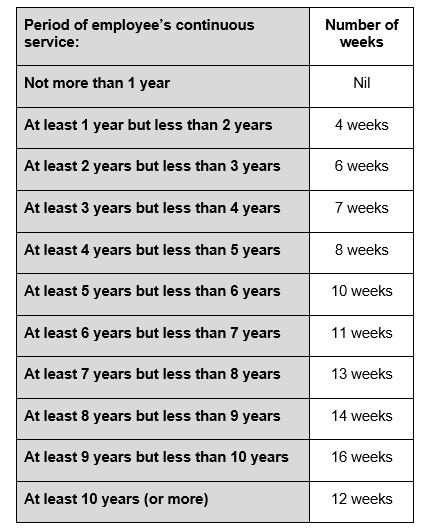

Redundancy Pay

All employers (unless falling into an exemption listed below) are required to at least pay the following minimum required by law is according to the following scale:

Exemptions from Redundancy Pay

The following are exempt from paying Redundancy Pay:

1. SMALL BUSINESS: Exempt small businesses are not legally required to pay Redundancy Pay. An exempt small business employer is an employer who employs less than 15 employees within its group of associated entities but excludes:

a. irregular casuals; and

b. employers in a specialty where there is still a requirement to pay some redundancy pay in accordance with a Modern Award (even where less than 15 employees), if the Modern Award provides for that to occur (e.g. see the Building and Construction On-Site Award 2020).

2. SPECIAL ENGAGEMENT: Where the employment ends due to the ending of an employment contract & relationship due to the end of:

a. a fixed/maximum term;

b. a specified task/project

c. a season;

where the termination is according to the terms of the contract only.

3. VARIOUS OTHERS: If the employee was fired because of serious misconduct; irregular casuals; apprentices; or trainees.

Other Sources

If an enterprise agreement or contract of employment provides for a higher amount of Redundancy Pay, then you will need to comply with the higher amount of Redundancy Pay in the enterprise agreement or contract of employment.

ANNUAL LEAVE

On termination of employment, an employee is entitled to be paid out for any accrued but untaken annual leave.

Payment must be made at the amount the employee would have been paid had they taken the annual leave and were still employed.

This means, if an employee is entitled to be paid a leave loading or other loadings, that must be paid out too. Relevant reference points will be any relevant Modern Award, contract of employment, or enterprise agreement.

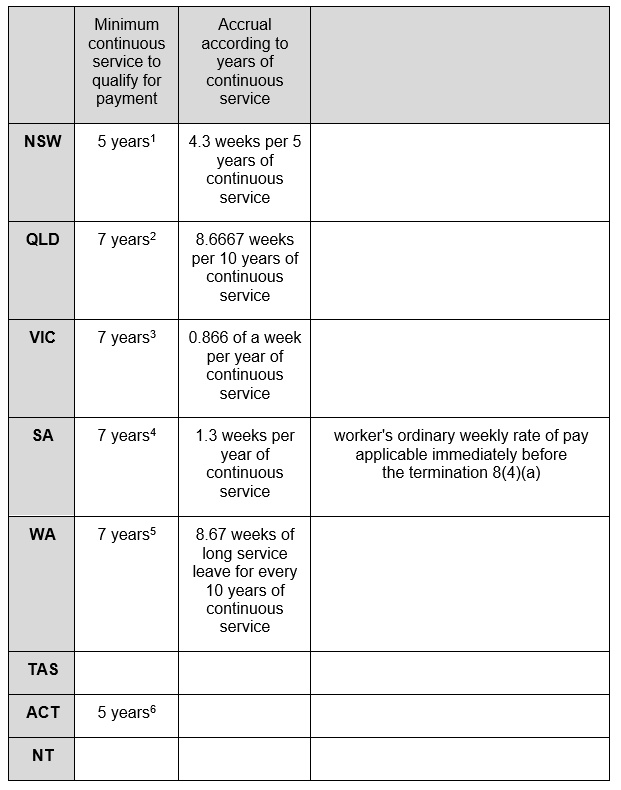

LONG SERVICE LEAVE

On termination of employment due to a redundancy, an employee is entitled to be paid out for any accrued but Long Service Leave.

A large number of employees are covered by general State/Territory Long Service Leave legislation. This is not always the case.

Alternative sources of Long Service Leave include:

Portable Long Service Leave Schemes (industry specific: care, building and construction, black coal, cleaning)

Enterprise agreements

Pre-reform instruments

[1] LSL Act 1955 (s.4(2)(a)(iii))

[2] IR Act 2016 (s.95(3))

[3] LSL Act 2018 (s.6)

[4] LSL Act 1987 (s.5(3))

[5] LSL Act 1958 (s.8(2)(a))

[6] LSL Act 1976 (s.11C)

Long service leave

1. Overview

Long service leave forms part of the National Employment Standards (NES). The NES apply to all employees covered by the national workplace relations system, regardless of any award, agreement, or contract.

The NES set out the entitlement to long service leave. This entitlement is a transitional entitlement pending the development of a uniform national long service standard.

Download the fact sheet:

NSW Long Service Leave Calculator: HERE

QLD Long Service Leave Calculator: HERE

VIC Long Service Leave Calculator: HERE

SA Long Service Leave Calculator: HERE

WA Long Service Leave Calculator: HERE

ACT Long Service Leave Guide: HERE

TAS Long Service Leave: HERE

NT Long Service Leave: HERE

What entitlements to long service leave will apply?

Under the NES, an employee is entitled to long service leave in accordance with their applicable pre-modernised award. Modern awards (from 1 January 2010) cannot include terms dealing with long service leave.

However, an employee’s long service leave entitlement derived from a pre-modernised award does not apply where:

a collective agreement, an Australian Workplace Agreement (AWA) made after 26 March 2006, or an Individual Transitional Employment Agreement (ITEA) came into operation before the commencement of the NES, and applies to the employee or

one of the following kinds of instruments came into operation before the commencement of the NES, applies to the employee, and expressly deals with long service leave:

an enterprise agreement – agreements made after 1 July 2009 and approved by the Fair Work Commission (FWC)

a preserved State agreement – an agreement made in the State system before 26 March 2006

a workplace determination – made by the FWC

a certified agreement – an agreement made before 26 March 2006

an AWA – made before 26 March 2006

a section 170MX award – an award made by the Australian Industrial Relations Commission (AIRC) before 26 March 2006 after terminating a bargaining period

an old IR agreement – an agreement approved by the AIRC before December 1996.

When one of the above specified instruments ceases to operate, an employee is entitled to long service leave in accordance with an applicable pre-modernised award.

2. Interaction between State and Territory long service leave laws and enterprise agreements

The content of an enterprise agreement made during the period 1 July 2009 – 31 December 2009 will prevail over State or Territory long service leave laws.

From 1 January 2010, if a pre-modernised award does not apply to an employee, any entitlement to long service leave will be derived from applicable State or Territory long service leave laws. The State or Territory long service leave laws generally prevail over any provisions in an enterprise agreement to the extent that they are inconsistent with those laws.

3. Agreement-derived long service leave entitlements

In some circumstances, the FWC can make an order which preserves long service leave entitlements contained in a collectively bargained agreement (such as enterprise agreements, collective agreements, pre-reform certified agreements and old IR agreements). In this instance, the agreement terms prevail over the State or Territory long service leave laws.

This can occur where:

the agreement came into operation prior to 1 January 2010

the agreement has terms dealing with long service leave

the agreement applies to employees in more than one State or Territory

the agreement provides entitlements which are equal to or greater than the relevant State or Territory long service leave laws

there are no applicable long service leave entitlements derived from a pre-modernised award which applies to the employees.

4. What if there are no applicable award or agreement-derived long service leave entitlements?

If there are no award or agreement terms regarding long service leave as set out above, the entitlement to long service leave comes from State and Territory laws. These laws are subject to the interaction with any transitional instrument that applies to the employees. Generally, these transitional instruments prevail to the extent of any inconsistency over any State or Territory long service leave laws.

5. What are the minimum long service leave entitlements?

Depending on the relevant State/Territory law or industrial instrument (such as an award or agreement), an employee may be entitled to long service leave after a period of continuous service ranging from seven to fifteen years with the same or a related employer.

Untaken long service leave is usually paid on termination, although this can depend on the circumstances of termination. Depending on the relevant law or instrument, an employee may be eligible for a pro-rata payment on termination after a minimum period of five years continuous service.

6. Can an enterprise agreement discount periods of service for long service leave?

Where an enterprise agreement replaces a collective or individual agreement or other specified instrument (such as a workplace determination) that operated before the commencement of the NES, and stated the employee was not entitled to long service leave, an employee’s service under the former agreement can be discounted for the purpose of long service leave.

The enterprise agreement may include terms that an employee’s service with the employer during a specified period does not count as service for determining long service leave entitlements under either the NES or a State or Territory law. The period is some or all of the period when an employee was covered by the collective or individual agreement or other specified instrument (such as a workplace determination).

If the enterprise agreement includes terms excluding prior service, it does not count as service for determining long service leave entitlements under either the NES or a State or Territory law. However, the period for long service leave entitlement purposes can be reinstated by a later agreement, either through an enterprise agreement or a contract of employment.

Accrued but untaken paid personal/carer’s leave

INSOLVENCY - BANKRUPTCY

What happens if my employer goes bankrupt or into liquidation?

Sometimes businesses shut down because they aren't profitable or run out of money. This can mean that employees lose their jobs, and in some cases, the employer may not be able to pay them the wages and entitlements they are owed.

When a business is bankrupt, also known as going into liquidation or insolvency, employees can get help through the Fair Entitlements Guarantee (FEG).

The FEG is available to eligible employees to help them get their unpaid entitlements.

This can include:

wages - up to 13 weeks unpaid wages (capped at the FEG maximum weekly wage)

annual leave

long service leave

payment in lieu of notice of termination - maximum of 5 weeks

redundancy pay - up to 4 weeks per full year of service.

It doesn't include:

superannuation

reimbursement payments

one-off or irregular payments

bonus payments

non-ongoing or irregular commission.

For more information visit the Department of Employment and Workplace Relations FEG webpage or call the FEG Hotline on 1300 135 040.

About the Author:

Joe is an employment relations lawyer with over 20 years’ experience specialising in workplace relations at mid-tier and employer associations.

His experience extends to providing advice and representation in matters across Australian tribunals and courts, including the Fair Work Commission and the Federal Courts of Australia. Joe has also successfully represented clients in various inquests and commissions of inquiry, including in the Independent Commission Against Corruption and various State Coroner’s Inquests and Inquiries.